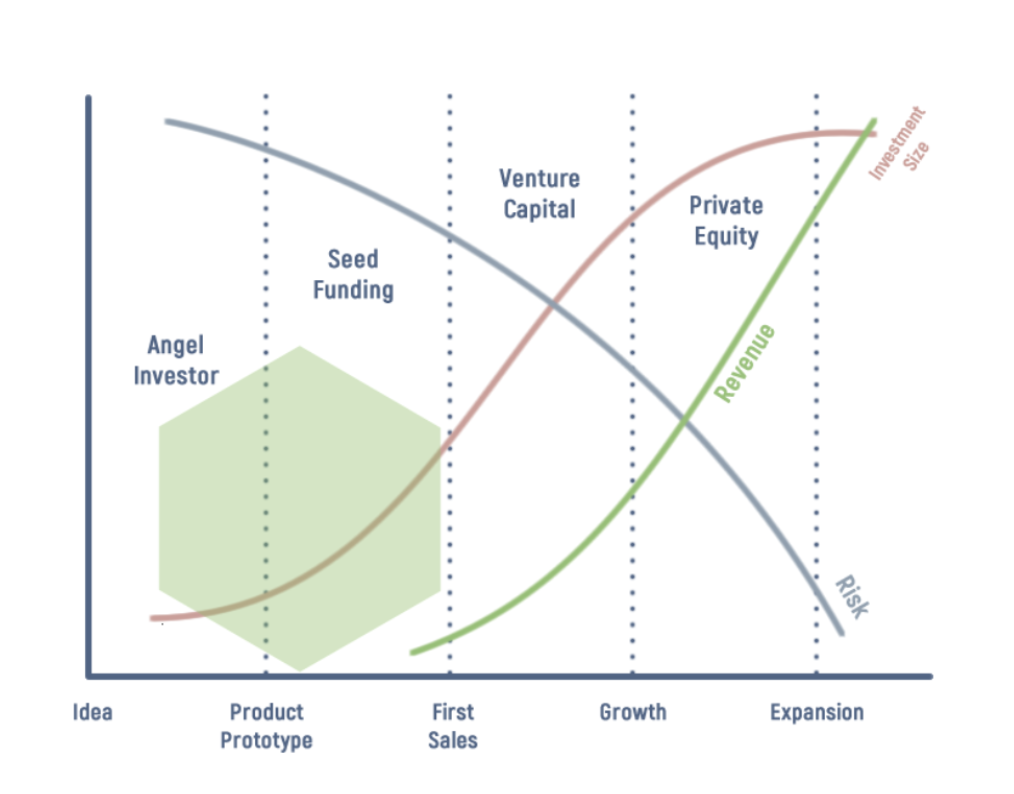

There is quite disagreement in question of what phases of start-ups are and how to segment them. Below are sum up of let say most known ones, each one is connected with different approach of looking for an investor and different places where you can get some money for your start-up.

During the first phase, a business plan and an initial prototype are formed. At this stage is created an environment in which the start-up will be able to grow. There is market research to be done, identifying the potential of the product, also creating a business strategy.

In this stage it's good to find an angel investor who is looking for young entrepreneur with a brilliant idea who he can help and provide him with his experience and skills in running a company. Another possibility is going for a grants or crowdfunding, only disadvantage of those ways are in their providing you only with money and nothing else and most often young founders need in this phase experience and guidance as much as money itself.

In this phase, the company is established and the business idea is initially tested, the product first enters the market and begins to be modified based on the first feedback from customers. In this phase you are looking for someone who is requiring from his invested start-ups some proof that founders did the basis and there is an actual interest for their product. You are going to have provide data of what you did, what you have behind your and what will help you acquire more growth in other words what is going to give you a head start apart from others.

In this phase you can also begin to see some emerging venture capitalist who are lately more focusing on this phase of start-up development beginning to see potential in relatively early start-ups.

At this stage, the start-up has already proved more or less successful, the business model has stabilized and it is starting generate the first major profits. At this phase you can find more or less passive investor who are mainly looking for valorising their saving, therefore you should definitely have your numbers straight up and show potential investor that you have a drive and competitive advantage which can take you to next stage of growing your start-up.

But be not misguided in this phase you can also find investors who are seeing that you have already proved to be self-sustainable and are happy to help you in growing it. Of course, in this phase VC are more active as they can see clear track record of your success and begin to see straight path to grow it further and then to sell it to some big player. (for classic VC to fund you, you need about 30 000 - 50 000 EUR MRR).

In the expansion phase, the company achieves a stable profit and tries to reach other markets with new products. It does this by creating divisions or setting up new companies. In this phase angel investors can sparely help since there are just several of them who can bring out several millions EUR out of their pocket. This is a playground for VC and even Private Equity who are looking for a stable firm who they can invest in and see stable future profits.

Maturity is the stage when the start-up has already reached its “adulthood”. It has a dominant position in the market and there is still growth, but not so sharp as in previous stages. In this phase start-up is ready either to generate a stable income for its investors or to be picked out by some big player like Microsoft or Apple as it often happens. This is goal of most VC and PE and in this phase there is more about gathering fruits of hard work than looking for another investors.

Throught out all phases there several options of where to look for an investor in each one of them. Busyman platform can help you with looking for an investor in several of them ranging from Pre-Seed to Expansion where in first phases we can connect you with angels who are looking for young and energetic founders with a good idea and in later stages we can connect you with top czech funds which are looking for start-ups with a stable MRR, growing user base and big potential for scaling up. You can find more about how we work with start-ups and with what we can help you here.

Throught out all phases there several options of where to look for an investor in each one of them. Busyman platform can help you with looking for an investor in several of them ranging from Pre-Seed to Expansion where in first phases we can connect you with angels who are looking for young and energetic founders with a good idea and in later stages we can connect you with top czech funds which are looking for start-ups with a stable MRR, growing user base and big potential for scaling up. You can find more about how we work with start-ups and with what we can help you here.